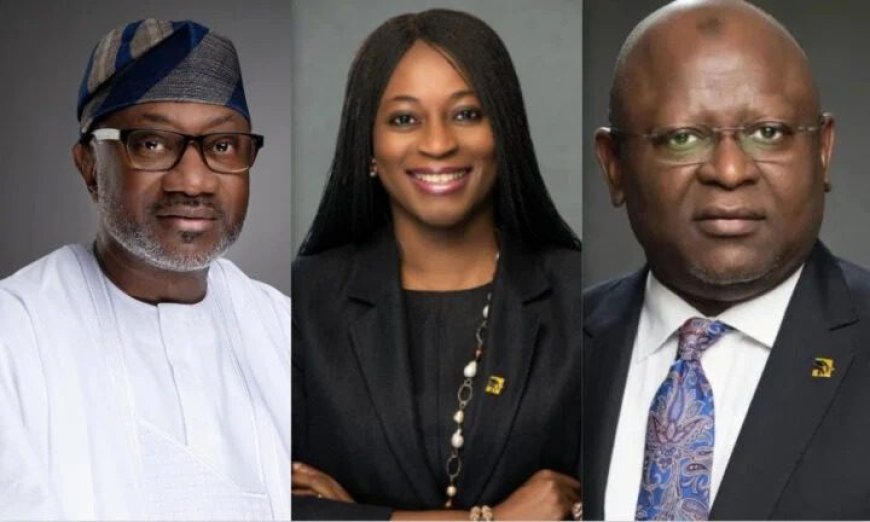

Single Largest Shareholder of First Bank, Otedola Demands Resignation of Bank Marketing Chief Over 'Lavish Party' Spree

Israel Adeleke

OPEN TELEVISION NAIJA (OTN) News reports as gathered that the single largest shareholder with a 9.41 percent stake at one of Nigeria’s largest banks, FirstBank Ltd, Femi Otedola, has been reportedly said to have demanded the resignation of the former financial institution Global Head of Marketing and Corporate Communications, Folake Ani-Mumuney.

OTN News further reports that, Ani-Mumuney, one of the most experienced and respected marketing executives in Nigeria, who has been instrumental in shaping the bank’s communication and marketing strategies resigned after the demand.

Furthermore, a reports from a news source suggested that her resignation was prompted by the bank’s chairman, Femi Otedola.

According to the report, Mr. Otedola was “seriously irked” by a lavish send-off party organized by the bank for its former Managing Director, Adesola Adeduntan. The event, held at Harbour Point, Victoria Island, Lagos, on November 2, was in honour of Adeduntan, who served as GMD and CEO for nine years until April 2024.

OTN News observed that, Adeduntan himself resigned earlier this year under controversial circumstances as Mr. Otedola sought to reposition the bank for stronger competition.

The report highlighted Mr. Otedola’s frustration with the lavish send-off party, describing it as “insensitive and wasteful,” especially during a time when the bank is focused on recapitalisation and restructuring for greater efficiency.

OTN News understands that FirstBank is undergoing a significant restructuring, with cost reduction emerging as a primary objective.

FBN Holdings reported operating expenses of N421.3 billion in the first nine months of 2024, a sharp increase from N212.1 billion recorded in the same period last year. Advertising and promotional expenses also surged to N44.5 billion, compared to N20 billion a year earlier.

The bank’s share price has gained 11% year-to-date, currently priced at N26 per share. FirstBank is also undergoing a rights issue aimed at bolstering its capital base.

OTN News also reports that sources close to the news source suggest that Mr. Otedola is committed to streamlining the bank’s operations and has consistently cautioned against “extravagant” spending.

The company reportedly plans to implement more “drastic” measures to ensure FirstBank maintains a standard of impeccable banking that is “devoid of extravagance and waste of shareholders’ resources.”

What's Your Reaction?